|

|

|

Figure

1:

Fluctuation on the availability of green grass round

the year |

| Livestock Research for Rural Development 26 (10) 2014 | Guide for preparation of papers | LRRD Newsletter | Citation of this paper |

The present study attempts to examine the scenario of dairy industry and the role of private sectors for its development in Bangladesh. In Bangladesh, more than half of the people is based on agricultural and livestock farming. The dairy sector is an integral part of farming systems and has created both direct and indirect employment opportunity, improved food security and enhanced supply of quality protein to people’s meals, contributing country’s economic growth and reducing poverty level in rural and urban areas of Bangladesh. Recognizing this fact, government has changed its policy and has given equal priority to both public and private sectors to solve the problem in dairy industry through different activities. Apart from this, government is also encouraging private sectors and NGOs to undertake steps for the development of dairy industry by liberalizing its present policy.

This review study has tried to unearth the present scenario of dairy industry in Bangladesh, contribution of private enterprises and NGOs for the development of dairy sectors and explores the scope and opportunity of dairy industry of Bangladesh. It was revealed that the private sectors implements dairy development program towards rural and urban areas of Bangladesh. This paper has also explored the status of dairy business development through various programs designed and implemented by private sectors.

Keywords: dairy animals, marketing systems, milk

The economy of Bangladesh is based primarily on agriculture, and livestock is an essential component of the rural economy. Dairying is one of the major components of animal agriculture and part of mixed farming system in Bangladesh (Saadullah 2001). Miyan (1996) stated that dairying is the predominant source of income generation. It accounts for about 14.08% (DLS 2013) of agricultural GDP and contributes to the livelihoods of many small scale farmers through income, employment and food (Bangladesh Economic Survey 2009). Increased milk production strategy is establishment of dairy enterprise in which small-scale farmers can successfully engage in order to improve their livelihoods (Hemme et al 2005). According to the national health strategy, the people of Bangladesh (153.6 million) should have 250ml of milk every day, then the annual national milk demand will be 14.02 million tonnes (DLS 2013-14). However, at present the country is producing only 6.09 million tonnes of milk which is only 43.5% of the milk demand in Bangladesh (DLS 2013-14). To fulfill the extra demand, Bangladesh imports a huge amount of powder milk and dairy products. Under these circumstances, to meet up the deficiency of milk and milk products in a shortest possible time, the government and private organizations are putting efforts to enhance the present milk production status. Besides government, there are many private and cooperative enterprises, like Bangladesh Milk Producers' Cooperative Union limited (BMPCUL) known as Milk Vita, Bangladesh Rural Advancement Committee (BRAC), Lal Teer Livestock Limited (LTL), Pran Dairy, Gentech International, EJAB and Grameen Motso O Pashusampad Foundation (GMPF) are working for dairy breed development program and providing technical assistance to the farmers.

Milk Vita is the largest commercial milk processors and cooperative organisation in the country which sells about 52% of the processed liquid milk and dairy products of the country (Table 10). A good number of other private enterprises like BRAC Dairy (Aarong), Pran Dairy, Amo milk, Bikrompur Dairy, Ultra Shelaide Dairy, Aftab Dairy, Grameen, Rangpur Dairy, Akiz Dairy are also collecting and processing milk and milk products in the country. They are also providing various services to the dairy farmers, like milk collection facilities, veterinary and animal health services, artificial insemination services, balance cattle feed, loan for cattle purchase, etc., as a part of their milk production enlargement and milking animal improvement.

Though private sectors is an important part of dairy industry in Bangladesh, there is no documented research studies so far that investigated the role of private sectors in the development of dairy industry. The purpose of this study is to examine the role of private sectors in the development of dairy industry in Bangladesh. In order to establish future plan for the dairy development in the country, it is essential to know details about the private enterprises, NGOs and their activities. Therefore, the present study was undertaken to identify the contribution of private sectors to the dairy industries and farmers and to know whether their performance is sound enough for further growth and development for dairy sectors in Bangladesh.

Milk selling and purchasing in the East Bengal (present Bangladesh) started after the Ghosh had come here. They migrated from parts of India to East Bengal at the middle of 17th century. The Gosh is a tribe who by tradition buy milk from the farmers and sell the commodities as fresh milk, sweetmeat, chhana, whey, curd, cream and ghee (butter oil) to the city consumers. The Gosh colonies in Shatkhira, Sirajgonj and Chittagong are still engaged in the dairy business. In 1830, the Ghosh of Chittagong used to market milk and milk products for Chittagong Metropolitan areas. The local Red Chittagong cows were used for this purpose. The cows were yielding 2-4 liter milk per day/cow. One of the oldest veterinary hospitals was identified in Chittagong and was established in 1890. Similarly, the Ghosh of Pabna and Khulna districts were used to marketing milk and milk products in Kolkata. Milk Vita was established in 1974 at Baghabarighat at Sirajgonj district. The cultivation of leguminous forage and feeding cattle with that at Shahjadpur, prominent area of Sirajgonj district has a long history. In the late nineteenth century, Rabindranath Tagore, the Nobel Laureate poet who was also the land lord of Shahjadpur, leased his land to the cattle farmer. This land is still being used as Bathan, means of the grazing cattle herd. At the beginning of 1990, farmers adapted the cultivation of high yielding fodder (Napier and others). Artificial insemination centers were extended to different districts and sub-districts in 1974. Mostly, Shahiwal bull semen was used. Farmers started rearing Friesian cross bred cows from the beginning of the 1980s.

Up until the early 1990s, BMPCUL used to be the only formal sector that processed and marketed milk from the producers of Bangladesh. Liberalization and market reforms in the 1990s along with increasing demand for milk and milk products accompanying per capita income growth and urbanization and improvements of infrastructure have brought about greater private sector participation in the dairy sectors. However, much of the potential of the dairy industry in Bangladesh remained unexplored with regard to input service delivery to farm activities and involvement of industries in post harvest processing and marketing of milk.

In Bangladesh, cattle, buffalo and goat are considered as dairy animals. Out of total milk production, about 90% is coming from cattle, 8% from goat and the remaining 2% from buffalo (BBS 2012). According to the data of DLS (2012) there are about 23.1 million cattle, 1.39 million buffaloes and 24.2 million goats in the country (Table 1). Among the total cattle population, about 6 million are dairy cattle of which about 85-90% are indigenous and 10-15% are crossbred. Indigenous cattle consisted of (a) Non-descript Deshi, (b) Red Chittagong cattle, (c) Pabna cattle, (d) North Bengal Gray and (e) Munshigonj White cows. On the other hand, crossbred cattle are the results of crossing between local with different exotic breeds like Holstein, Friesian, Sindhi, Shahiwal, Jersey at different level. Black Bengal, the only dairy goat breed comprises 90% of the total population. Buffalo in Bangladesh is mainly indigenous in origin and most of them are riverine type with exception of some swamp type in Eastern part and have low productivity. There are also some cross breed with Murrah, Nili-Ravi, Surti and Jaffrabadi sorrounding of Indian border (Faruque et al 1990; Huque and Borghese 2012).

|

Table 1: Population and growth rate of dairy animals in Bangladesh |

||||||

|

Year |

Cattle |

Buffalo |

Goat |

|||

|

Number (million) |

Growth (%) |

Number (million) |

Growth (%) |

Number (million) |

Growth (%) |

|

|

2002-03 |

22.5 |

- |

1.01 |

- |

17.7 |

- |

|

2003-04 |

22.6 |

0.31 |

1.06 |

4.95 |

18.4 |

4.07 |

|

2004-05 |

22.7 |

0.31 |

1.11 |

4.72 |

19.2 |

4.07 |

|

2005-06 |

22.8 |

0.57 |

1.16 |

4.50 |

19.9 |

4.07 |

|

2006-07 |

22.9 |

0.31 |

1.21 |

4.31 |

20.8 |

4.06 |

|

2007-08 |

22.9 |

0.31 |

1.26 |

4.13 |

21.6 |

3.90 |

|

2008-09 |

22.2 |

0.33 |

1.30 |

3.49 |

22.4 |

3.90 |

|

2009-10 |

23.1 |

0.15 |

1.35 |

3.85 |

23.3 |

3.91 |

|

2010-11 |

23.1 |

0.30 |

1.39 |

3.26 |

24.2 |

3.76 |

|

Average (%) |

0.32 |

|

4.15 |

|

3.97 |

|

|

Source: DLS (2012) |

||||||

Majority of the dairy cattle farms in the country are private which can be categorized into five different groups:

The large and medium size farmers keep 1-3 cows to meet primarily their household demand for milk products, and the surplus being sold in the local market.

Households depending mainly on draft power for cultivation usually keep 2-6 cows including both bulls and dairy cows and often have to use their dairy cows for ploughing. During the off season when cows are free from agricultural farm use, they produce milk which is usually sold in the market.

The small and medium sized households with financial and technical support from the government, NGOs and cooperatives manage to rear 2-5 cows. They usually sell all their milk and milk products in the market.

The medium sized household receiving mostly government incentives or cooperative support established dairy farms where they usually rear 6-25 cows for market sale of milk and milk products.

These commercial operations establish modern dairy farms and keep 26+ cows (Halder and Barua 2003).

There are also eight government dairy cattle farms throughout the country, basically being used as breeding purposes for supplying of heifers to small-scale farmers.

There is no dairy buffalo farm in the country in public/private level. Buffaloes are managed mainly as draught purpose in household subsistance farming that can give milk to the family in low quantity. About half of the buffaloes are reared on the coastal area of the Southern part under extensive farming (Bathan farming), mostly for meat production and partially for milk production. Recently, the Directorate of Livestock Services and Bangladesh Livestock Research Institute started joint buffalo improvement program. Another private company, Lal Teer Livestock Limited started buffalo development program to create dairy and meat buffalo in the country. Number of dairy cattle and goat farms and self employment record are shown in Table 2.

|

Table 2: Number of registered dairy farms, goat farms and self employment records in private sectors |

||||

|

Year |

Dairy Farm |

Goat Farm |

||

|

Number |

Self Employment |

Number |

Self Employment |

|

|

1979-1980 |

227 |

2270 |

- |

- |

|

1997-1998 |

29,600 |

296,000 |

20,900 |

104,200 |

|

2000-2001 |

32,600 |

326,000 |

24,900 |

125,000 |

|

2004-2005 |

52,000 |

520,000 |

26,000 |

130,000 |

|

2009-2010 |

79,900 |

98,500 |

56,200 |

281,000 |

|

Source: DLS (2011) |

||||

The availability of green forage is largely affected by season, for example, forages are available in large quantities in monsoon, when plant growth accelerates and it is scarce in dry season and during flood. These cause the forage supply to animals in our country highly fluctuating. Figure 1 shows the fluctuation in the availability of green forages round the year. This fluctuating supply of forages is one of the reasons for low average milk yield of dairy animals as because it is a prerequisite for maintenance of equal level of milk yield throughout the year. There are two major feed shortage periods in the country. The most severe one is during July to October when most of the fields are under rice cultivation and all low lying areas are flooded. Another feed shortage period is during late March to late April (dry period) when the winter forages are finished and summer species are just sprouting.

|

|

|

Figure

1:

Fluctuation on the availability of green grass round

the year |

The nutrients requirement of dairy animals in the country is exhibited in Table 3. It is observed that total DM, DCP and ME required for dairy animals are about 46,000 and 30,000 MT and 40,000 million MJ (2010-11), respectively.

|

Table 3: Nutrient requirements for dairy animals in Bangladesh |

||||||

|

Species |

Year |

No of Animals |

Ave. LW |

DM

|

DCP

|

ME

|

|

Cattle |

2003-04 |

22.6 |

150 |

37,200 |

2,300 |

305,000 |

|

2010-11 |

23.1 |

150 |

38,000 |

2,400 |

312,000 |

|

|

Buffalo |

2003-04 |

1.06 |

200 |

2,700 |

124 |

17,400 |

|

2010-11 |

1.39 |

200 |

3,550 |

162 |

22,800 |

|

|

Goat |

2003-04 |

18.4 |

12 |

3,360 |

336 |

43,700 |

|

2010-11 |

24.1 |

12 |

4,400 |

440 |

57,200 |

|

|

Total equirement for dairy animals |

2003-04 |

43,200 |

2,770 |

366,000 |

||

|

2010-11 |

45,900 |

2,970 |

392,000 |

|||

|

Source: DLS (2012) |

||||||

The nutrient supply and demand balance is presented in Table 4. Several survey studies in the past and present have reported clearly the severity of animal feed and nutrient shortage in Bangladesh. According to DLS report (2005), the availability of feeds and fodder for dairy animals is 70.8% DM, 17.5% DCP and 65.7% ME. From a recent study, the availability of feeds and fodder is 80.3% DM, 26% DCP and 66.1% ME with the deficits of 19.7% DM, 74.1% DCP and 33.9% ME, respectively (Sarker et al 2012).

|

Table 4: Nutrients availability for dairy animals in Bangladesh |

|||

|

Demand/Supply |

DM (000, MT) |

DCP (000, MT) |

ME (Mill. MJ) |

|

2003-2004 |

|||

|

Demand |

43,200 |

2,770 |

366,000 |

|

Supply |

30,600 |

484 |

240,600 |

|

Balance |

-12,600 |

-2,286 |

-125,400 |

|

Availability (%) |

70.8 |

17.5 |

65.7 |

|

2010-2011 |

|||

|

Demand |

45,900 |

2,960 |

392,000 |

|

Supply |

36,900 |

769 |

259,000 |

|

Balance |

9,000 |

2,190 |

-133,000 |

|

Availability (%) |

80.3 |

26.0 |

66.1 |

The milk production of last ten years along with growth rate (%) is shown in Table 5. The average growth rate for 10 years was 7.11%. The production of milk was expected to show a significant increase during the perspective plan (2002-2012) period (DLS 2013). It was expected that milk production will increase from 1.82 Million Metric Ton (MMT) (2002-03) to 2.28 MMT (2006-07) and 3.46 MMT in (2011-12). However, the target was not achieved. The milk production was increasing slowly up to 2007-08. In the year of 2008-09 and 2009-10 it was decreasing. Thereafter in the year 2009-10 and 2010-11 milk production increased by 25% and 17.3% respectively, which is the highest increment rate during the last ten years.

|

Table 5: Yearly milk production and its growth rate (%) in Bangladesh |

||

|

Year |

Milk |

|

|

Production (MMT) |

Growth rate (%) |

|

|

2002-03 |

1.82 |

- |

|

2003-04 |

1.99 |

9.34 |

|

2004-05 |

2.14 |

7.54 |

|

2005-06 |

2.27 |

6.06 |

|

2006-07 |

2.28 |

0.44 |

|

2007-08 |

2.65 |

16.3 |

|

2008-09 |

2.29 |

-13.9 |

|

2009-10 |

2.36 |

3.06 |

|

2010-11 |

2.95 |

25.0 |

|

2011-12 |

3.46 |

17.3 |

|

Average growth rate for 10 years (%) |

7.11 |

|

|

Source: DLS (2013) |

||

Consumption of milk and milk products in the country is carried out in different ways: directly from the producers, from the vendors and from the commercial milk processors and manufacturers. An adult person requires at least 250 ml milk every day, but the availability is only about 108.66 ml/h/d. This figure indicates that we are in shortage of milk. Total milk production of the country is 6.09 MMT/year (2013-14) but the requirement is about 14.02 MMT/year. From this figure it can be said that the deficiency is about 56.6% (Table 6). If we look forward about the milk consumption pattern of South Asian Association for Regional Cooperation (SAARC) countries (Table 7), then it is easy to understand that our position is at the bottom of all SAARC countries in terms of milk consumption.

|

Table 6: Requirement, production and deficit of milk |

||

|

Per day |

Per year |

|

|

Requirements |

250 ml/h/d |

14.02 MMT |

|

Production/Availability |

109 ml/h/d |

6.09 MMT (43.5%) |

|

Deficiency |

141 ml/h/d |

7.93 MMT (56.6%) |

|

Source: DLS (2013) |

||

|

Table 7: Comparative milk consumption rate in SAARC countries |

|

|

Countries |

Milk Consumption |

|

Bangladesh |

109ml/h/day |

|

India |

227ml/h/day |

|

Nepal |

140ml/h/day |

|

Pakistan |

520ml/h/day |

|

SriLanka |

142ml/h/day |

|

Maldives |

188ml/h/day |

|

Source: Khan (2014); DLS (2013) |

|

The huge gap between supply and demand is largely met by import of milk powder and cream from abroad. For this reason the country loses huge amount of foreign currency every year which is about USD 93.4 million (Bangladesh Bank 2012-13). Moreover, this powder milk which is coming from abroad is not totally safe for human consumption as because in the past, melamine (hazardous chemical dangerous for human health) was detected in the powdered milk in China. During 2008, powdered milk price in the international market was USD 5000-5500 per ton and affected the price of liquid milk in the local market which increased and remained high (BDT 30-38 per liter) until March 2009 (Chowdhury 2009). The increasing trend of liquid milk price resulted gradual flourishing of many small scale commercial dairy farms in the country. In addition, the high income elasticity of demand for milk mentioned earlier is good potential for growth in the dairy sectors. Attainment of high growth rate in the sector has the potential to get millions of smallholder producers and others to get involved in milk processing and marketing business and has created an opportunity for poverty reduction through employment and income generation. Dairy generates more regular cash income, and dairy production, processing and marketing generate more employment per unit value added compare to crops (Asaduzzaman 2000; Omore et al 2002).

|

Table 8: Yearly powdered milk and cream import status of Bangladesh |

||

|

Years |

Amount (MT) |

Cost (million USD) |

|

1999-2000 |

16,000 |

60 |

|

2000-2001 |

19,000 |

62 |

|

2001-2002 |

20,000 |

59 |

|

2002-2003 |

18,600 |

61 |

|

2003-2004 |

16,250 |

57 |

|

2004-2005 |

17,600 |

86 |

|

2005-2006 |

51,500 |

73 |

|

2006-2007 |

58,500 |

83 |

|

2012-2013 |

20,000 |

93.4 |

|

Source: Haque (2005); Bangladesh Bank (2013) |

||

Dairy cattle improvement program in Bangladesh was started in 1958 by DLS with artificial insemination program which was strengthened in 1975-76. However, in the absence of following the proper process of improvement like registering, recording and others, the government has not achieved any mark over this long period of 55 years. The dairy cattle improvement project was undertaken as an annual development project on AI for 5 years and after the completion of the project period, required attention was not given to follow the next steps until a new AI project was initiated. For improvement of buffalo, the government has run a 5 year project named Buffalo Development Project since July 2009 and using Mediterranean Murrah for breed up-gradation. The price of government semen is presented in Table 9. Many private and cooperative enterprises and NGO’s are working for development of livestock resources since long time following the government initiated breeding policy. Government also encourages the private sectors and entrepreneurs to take part in the development process of livestock sector of the country.

Milk Vita, the trade name of BMPCUL is the largest dairy cooperative in Bangladesh, started dairy business based on genetic improvement of dairy cattle through AI services of their cooperative farmers in 1972. In addition to semen, BMPCUL has periodically imported Shahiwal bulls from Pakistan (1991) and four Friesian and three Jerseys bulls from Australia (2002). Initially, BMPCUL started to produce and use liquid semen, later they shifted towards producing frozen semen. The BMPCUL artificial insemination service is limited to their cooperative farmers only. They do not sell semen outside farmers. In 2012-13, they produced 91,000 doses frozen semen and inseminated 1,00,000 cows (including previous frozen semen stock). The price of their semen is presented in Table 9. They have trained employed livestock field assistants (LFA-AI) who serve the cooperative farmers for AI service on call basis by the following distribution channel:

|

|

Bangladesh Rural Advancement Committee (BRAC), an international NGO started cattle breeding program with AI services using government liquid semen in 1985 in Manikganj district of Bangladesh using trained AI technicians. BRAC has started trial semen production (from 19 bulls) from May, 2000. However, this NGO has established its own bull station and started actual frozen semen production from November, 2000. They select bull through progeny collection from the field/smallholder farmers and bring them to bull station and collect semen after final selection of bull for processing and marketing. By now they have trained 2523 AI technicians and operating AI services in 61 districts (440 upazilas) out of 64 throughout the country through 89 points. In 2013, they produced 13,00,000 doses frozen semen and inseminated 13,24,000 cows (including previous frozen semen stock) throughout the country. They are also producing frozen semen from goat to develop high milk and meat producing goat in the country. The cost for single doses of BRAC semen is presented in Table 9. At present, BRAC is in the process to expand more AI services through the country. They are producing and distributing frozen semen to the farmers by the following distribution channel:

|

|

|

Source: BRAC report |

Lal Teer Livestock, an associates of the Bangladesh’s largest private sector seed company Lal Teer Seed started cattle and buffalo improvement program since 2009. They are producing semen from locally produced environmentally supported proven bull at different blood levels crossing with the imported frozen semen of Holstein, Frisian, Jersey, Shahiwal and Mediterranean buffalo and distribution/marketing it through artificial insemination for increasing milk and meat production throughout the country. They have buffalo improvement program at household farming, semi-intensive and extensive farming systems in selected regions of the country. At this moment their activities are limited towards trial basis, not selling their semen in the market. Their proposed frozen and liquid semen distribution channel is as follows:

|

Lal Teer Livestock Limited (LTL) and Beijing Genomics Institute (BGI) jointly sequenced buffalo genome under a three-year project based on Bangladeshi local buffalo stock. It was announced at a press briefing on January 24, 2014 by authorities of Beijing Genomics Institute and Lal Teer Livestock Limited. Hopefully it will increase the country’s milk and meat production using the genetic information of local buffalo.

The Pran Dairy is a private company which started dairy breed improvement program with frozen semen and AI services imports from World Wide Sire, USA. The price of their semen is presented in Table 9. They have selected Dairy Hub where they distribute frozen semen and AI services within their Hub member’s farmers by the following distribution channel:

|

|

The Gentech International is a private company that started dairy breed improvement program with frozen semen being imported from World Wide Sire. They have started to develop AI inseminator to provide training to the local field participants. The price of their semen is presented in Table 9. They help the farmers by selling frozen semen and AI services by the following distribution channel:

|

EJAB is a private company that started dairy breed improvement program through semen production and marketing. However, the company is reported to have suspended semen production due to low quality of semen and unscientific process. The price of their semen is presented in Table 9.

Besides these, Community Livestock and Dairy Development project of an NGO being executed by Grameen Motso O Pashusampad Foundation (GMPF) also working on breed development program with technical assistance from FAO.

Bangladesh Agricultural University is also involved in AI services to the farmers in and around the University areas. The frozen semen is originated from the government AI laboratory while liquid semen is produced by their own bull studs.

|

Table 9: Price of semen of different dairy breeds available in Bangladesh (BDT) |

||||||

|

Source/Suppliers of semen |

Breed/Type of animals |

Office price, Tk./Dose (Government price) |

Farmer’s price, Tk. /Dose |

|||

|

Frozen |

Liquid |

Frozen |

Liquid |

|||

|

DLS (Government) |

Friesian (any blood level) |

30 |

15 |

200-300 |

120-200 |

|

|

Local |

30 |

15 |

200-300 |

120-200 |

||

|

Sahiwal (any blood level) |

30 |

15 |

200-300 |

120-200 |

||

|

Friesian x Sahiwal |

30 |

15 |

200-300 |

120-200 |

||

|

Buffalo (very new) |

Free (under project selected area) |

|||||

|

MILK VITA |

Friesian |

100 |

|

only for cooperative farmers |

||

|

Jersey |

125 |

|

||||

|

BRAC |

Friesian |

125 |

|

200-300 |

|

|

|

Sahiwal |

140 |

|

200-300 |

|

||

|

Red Chittagong |

135 |

|

200-300 |

|

||

|

Friesian, Imported |

550 |

|

650 |

|

||

|

Goat |

40 |

|

|

|

||

|

Lal Teer |

Friesian |

On trial position, yet not in marketing |

||||

|

Jersey |

||||||

|

Buffalo |

||||||

|

Pran Dairy

|

Holstein Friesian |

325 |

|

only for Dairy Hub members |

||

|

Jersey |

325 |

|

||||

|

Gentech International |

Holstein Friesian |

250 |

|

300-400 |

|

|

|

Friesian |

250 |

|

300-400 |

|

||

|

EJAB

|

Friesian |

100 |

|

200-300 |

|

|

|

Sahiwal |

120 |

|

200-300 |

|

||

|

Source: Based on information collected through personal communication |

||||||

Consumption of milk and dairy products has been expanding dramatically with income growth, population growth, urbanization and dietary changes (Anon 2008). Bangladesh Milk Producers Cooperative Union Ltd. (BMPCUL) is the largest commercial milk processors and cooperative organization in the country which sells fluid milk and dairy products under the brand name Milk Vita and produces about 52% of the processed liquid milk of the country (Table 10). There are now a good number of enterprises like BRAC Dairy (Aarong), Pran Dairy, Amo milk, Bikrompur Dairy, Ultra Shelaide Dairy, Aftab Dairy, Grameen, Rangpur Dairy, Akiz Dairy etc. are collecting and processing of milk and milk products in the country. In 1990 processors collected just one percent of the total milk production of 1.5 million MT (30,000 liters per day); by 2006 this had increased to seven percent of 2.27 million MT (3,84,000 liters per day). The production and processing of milk through formal channels has increased in the last five years by about 10% or more per annum.

|

Table 10: Market share of liquid milk among the different enterprises |

||||

|

Processing companies |

Establishment Year |

Average milk collection ('000 liter/day) |

Market share (%) |

No. of producers supplying milk |

|

BMPCUL (Milk Vita) |

1973 |

200 |

52.08% |

150,000 |

|

BRAC Dairy (Aarong) |

1988 |

80 |

20.83% |

70,000 |

|

Pran Dairy |

2001 |

40 |

10.42% |

30,000 |

|

Amo milk |

1996 |

10 |

2.60% |

5,000 |

|

Bikrompur Dairy |

1998 |

10 |

2.60% |

6,000 |

|

Ultra Shelaide Dairy |

1998 |

10 |

2.60% |

4,000 |

|

Aftab Dairy |

1998 |

8 |

2.08% |

4,000 |

|

Tulip Dairy |

1998 |

3 |

0.78% |

2,000 |

|

Grameen/CLDDP |

1999 |

7 |

1.32% |

6,000 |

|

Grameen-Damone |

2007 |

1 |

0.03% |

- |

|

Rangpur Dairy |

2007 |

8 |

2.08% |

7,000 |

|

Akij Dairy |

2007 |

4 |

1.04% |

500 |

|

Savar Dairy |

1974 |

6 |

1.54% |

Government farm |

|

Total milk collection/day |

|

387,000 Liter |

100% |

284,500 |

|

Source: Adopted from S K Raha (2009) and other sources. |

||||

Prevention and control of parasites and diseases is an important item in all livestock production as this is one of the significant ways in which production costs can be lowered. With dairy cattle, this problem becomes even more important because of the public health factor. Several of the diseases like foot and mouth disease (FMD), Haemorrhagic Septicaemia (HS), anthrax, brucellosis, tuberculosis, black quarter, fasciolosis and ascariosis that affect dairy cattle with resultant financial loss from the production standpoint also are transmittable to the people. Therefore, it is of utmost importance that dairy man should follow approved practices in preventing and controlling parasites and diseases.

In view of the above circumstances, an association was made by different private company’s name “Animal Health Companies Association of Bangladesh (AHCAB)” since 2003 to conduct welfare of animal industry in the country. The main objectives of this association are:

- Promoting, educating and creating awareness in developing a sustained animal industry in the country.

- To work for the improvement of animal farmers by providing technical support; participate in training, research and development.

- To conduct research and development work with universities, research organizations and private farms.

- To support government policy in creation of job opportunities for unemployed youth and women and rural development.

- To ensure consumer safety for the animal products and welfare of the animal farmers.

- To assist farmers in production of eggs, milk, meat, fish and shrimps free of hazardous chemicals and harmful drugs.

- To patronize health, safety and environmental issues for both human and animals.

- To conduct international exhibition, seminar, symposium and workshop to create awareness for the farmers and other personnel in the industry.

Poverty is the major threat in the ways of economic development of the country. Government is taking various steps for reducing poverty. However, effects of that are surpassed by the rate of increase of unemployment and poverty. Number of NGOs and international donor agencies and private companies of home and abroad are taking various programs such as micro credits for agricultural inputs, training on small cottage industries, training youths for self employment, asset transfer in different forms, logistic support etc. to alleviate poverty from the society. Livestock production has proved them as successful means for poverty reduction in rural areas.

Intermittently month long training on AI funded by BRAC to the unemployed rural people is enabling them to earn money up to 40,000/= per month by doing AI to cows of the rural farmers. The logistic supports such as semen, preservation system, and others are being sold by BRAC. Youth training institute has been giving training to unemployed youths on livestock rearing and is also paving the way for the unemployed youths to earn money and reduce their poverty.

Chars Livelihoods Program (CLP) of Department for International Development (DFID) has been working for improvement of the livelihoods of the poor people of the chars of five districts of northern part of the country for the last 10 years through distribution of cattle as asset to the poor farmers so that they can improve their livelihoods by rearing livestock.

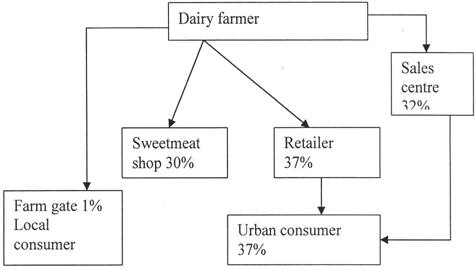

Milk marketing system in the country is not uniform. The existing milk marketing systems are categorized into following groups:

For traditional system, due to the nature of milk production there is no single channel for milk marketing. It varies from area to area. A few marketing channels of different areas of Bangladesh are shown in following figure:

|

|

Figure 2: Traditional marketing channels of milk at Rangpur (adopted from S K Raha 2009) |

|

|

Figure 3: Traditional marketing channels of milk at Bogra (adopted from S K Raha 2009) |

|

|

Figure 4: Modern marketing channels of milk at Rangpur (adopted from S K Raha 2009) |

|

|

Figure 5: Modern marketing channels of milk at Bogra (adopted from S K Raha 2009) |

Milk traders: Between farmers and consumers one intermediary was found who is variously called Doodwala, Bepari, Paiker, Goala and so on. They collect milk from individual farmers in small lots and sale them to sweetmeat shops, tea stall, urban market and consumers by home delivery.

Milk vita is a producers’ cooperative involved in milk collection, processing and marketing as well as providing some dairy inputs and services (AI and concentrate feeds) in some parts of the country since mid-1970s. For cooperative marketing system, dairy farmers are organized into Samity at village level. Individual members deliver milk to a common collection point and from the collection point milk is brought to chilling plant. Milk vita has about 22 chilling plants in different places of the country. From chilling plant, milk is collected every day to its Baghabarighat (Sirajgonj) processing plant at Mirpur (Dhaka) central plant. Milk price is set on the basis of fat content. About 15% of national production of cow milk is currently being procured by Milk vita, BRAC dairy and PRAN dairy for processing to serve large urban markets.

There are a number of private companies and NGOs that are involved in milk and dairy products marketing in the country. Of these, BRAC dairy, Pran dairy, Amo milk, Bikrampur dairy, Aftab dairy, Akij dairy, Rangpur dairy, Grameen Motsho Foundation (a dairy initiative run by the Grameen Bank) are important. These private companies and NGOs follow the same procedures of collecting milk from the farmers through their agents who in turn collect milk from the farmers. Milk price is set on the basis of fat content.

|

|

Figure 6: Milk supply chain in Dhaka (adopted from S K Raha 2009) |

Consumption of milk and dairy products has been expanding dramatically with income growth, population growth, urbanization and dietary changes (Anon 2008). Three-fold increase in meat, milk and dairy product consumption is expected in South Asia from 1965 to 2030 (Anon 2008). Taking the modest population growth rate of 1.6% and per capita milk consumption of 120 ml, some 9.09 million tons of milk production will be required in the year 2025 in Bangladesh. The total yearly requirement will be 19.02 million tons if per capita daily milk consumption rose to 250 ml in the year 2025 in Bangladesh (Anon 2008). Therefore, the dairy industry will have to be the potential to grow much faster than the present growth rate. The most important and prerequisites for sustainable growth of this sector is the security of the feeds and nutrition of the dairy animals, particularly the availability of good quality forages. The daily feeding of green forage is probably the first one among many secrets of success in a dairy farm. Good quality forage contains most of the nutrients essential for maximum production of dairy animals. Where land and forage are available, milk production as a part of integrated crop-livestock activities may be more economically efficient and less risky than monoculture grain cropping.

Like elsewhere in the world, the dairy industry of Bangladesh is mostly demand driven. The elasticity to demand depends on population growth, income growth and urbanization. The steady population, urbanization and income growth reveal that there is an increasing demand of animal origin food like milk and meat. The deficit percentage (shown in Table 4) clearly indicates the potential dairy industry in Bangladesh.

It offers full or part time employment of a large number of people. This clearly indicates that there is scope for expansion of this industry.

There is a scope for foreign investors to invest in dairy production in Bangladesh. The government has created favorable environment for foreign investors in poultry sector, eg. CP, New Hope, Sokuna, Godrej

The international restaurants (KFC, Macdonald, Nandos, A & W ) have been operating in Bangladesh since last five years. Besides, fast food shops are also increasing every year. There is a demand of hygienically slaughtered meat in these shops. The male calf of the dairy farm can be used for this purpose and it has opportunities to set up more processing plant.

The government, animal health company and other private sectors are providing the technical services to the farmers. All animal health products and equipments are available in Bangladesh, which are promoting and supporting the growth of dairy industry.

There is the scope for Bangladeshi scientists, researchers to attend international/regional seminars/congress and to exchange their knowledge.

Government has also liberalized its policies to encourage the growth of dairy sector in Bangladesh by introducing tax holiday, subsidy in electricity and also incentives for export.

Dairy industry in Bangladesh is faced by several constraints that include poor genotype, limited feed availability, inadequate health care service, lack of cold chain, poor transportation, and unorganized marketing system. It is recommended that

Private sectors should be given priority on dairy production with low interest bank loans (1-3%), encouraging public and private sector partnerships and investments, strengthening cooperation between private organizations, NGOs with government sector.

Development of high yielding dairy breed through genetic improvement.

Increased feed and fodder production. It may be partially overcome by introducing HYV fodder cultivation.

Veterinary care and services to the farm owners should be strengthened.

The price of milk should be fixed at a reasonable level and milk marketing system should be improved through the intervention by the government. Milk preservation facilities should be created for the farmer to ensure the marketing of their product.

Improvements should be made to communication, power, water supply and modern storage facilities for dairy products.

Dairy products branding, labeling and advertising should be introduced.

Powdered milk imports should be reduced to encourage dairying in Bangladesh. National Milk Development Co-operation should be established.

Akbar M A and A B M Khaleduzzaman 2009 Feeds and Feeding–Survey of Feedstuff Availability. Handbook of Dairy Nutrition-Bangladesh, Edited by Peter H. Robinson and U. Krishnamoorthy. Published by American Soybean Association (ASA), International Marketing, New Delhi, India.

Anon 2008 High-value Agriculture in Bangladesh: An Assessment of Agri-business Opportunities and Constraints. World Bank Report, Bangladesh Development Series, Paper # 21.

Asaduzzaman 2000 Livestock sector, economic development and poverty alleviation in Bangladesh. In: Mandal MAS (ed), Changing rural economy of Bangladesh. Bangladesh Economic Association, Dhaka, Bangladesh. pp 1-20.

Bangladesh Bureau of Statistics 2012 Statistics Division, Ministry of Planning, Dhaka, Bangladesh.

Bangladesh Bank 2013 Annual Import Report. Bangladesh Bank, Government of the People’s Republic of Bangladesh, Dhaka, Bangladesh.

Bangladesh Bank 2012-13 Annual Report, Bangladesh Bank, Government of the People’s Republic of Bangladesh, Dhaka, Bangladesh.

Bangladesh Economic Survey 2009 Department of Finance, Ministry of Finance and Planning, Government of the People’s Republic of Bangladesh. Dhaka. pp 71.

Chowdhury S A 2009 Economics of fodder production in Bangladesh. Paper presented in national workshop on- Fodder Production and Artificial Insemination held on 21 May, 2009. Polli Karma Sahayak Foundation (PKSF), Sher-e-Bangla Nagar, Dhaka, Bangladesh.

DLS 2005 Annual Report on Livestock, Division of Livestock Statistics, Ministry of Fisheries and Livestock, Farmgate, Dhaka, Bangladesh.

DLS 2012 Annual Report on Livestock, Division of Livestock Statistics, Ministry of Fisheries and Livestock, Farmgate, Dhaka, Bangladesh.

DLS 2013 Annual Report on Livestock, Division of Livestock Statistics, Ministry of Fisheries and Livestock, Farmgate, Dhaka, Bangladesh.

Faruque M O, Hasnath M A and Siddique N U 1990 Present status of buffaloes and their productivity. Asia-Australian J. Anim Sci.3:287-292.

Halder S R and Barua P 2003 Dairy production, consumption and marketing in Bangladesh, Report on Research & Evaluation Division, BRAC.

Haque S A M A 2005 Prospects and constraints of dairy development in Bangladesh, Paper presented at training program for the small scale dairy sector, December 26, Dhaka, Bangladesh.

Hemme T, Garcia O and Khan A R 2005 A review of milk production in Bangladesh with particular emphasis on small-scale producers. Pro-Poor Livestock Policy Initiative. http://www.fao.org/ag/pplpi.html

Huque Q M E and Borghese A 2012 Production potentiality and perspective of buffalo in Bangladesh. In proceedings of the 15th AAAP Animal Science Congress, 26-30 November, 2012, Thailand. pp 244.

Khan M M 2014 Developing dairy industry in Bangladesh. Key Note paper presented in 2nd International Exhibition on Dairy, Aqua & Pet Animal, Dhaka, Bangladesh. pp 13-35.

Miyan H A 1996 Towards sustainable development: The national conservation strategy of Bangladesh. Consultancy report on the livestock sector. Ministry of Environment and Forestry, Dhaka, Bangladesh.

Omore A, Mulindo J C, Islam S M F, Nurah G, Khan M I, Staal S and Dugdill B T 2002 Employment generation through small scale dairy marketing and processing: Experiences from Kenya, Bangladesh and Ghana. FAO, Rome, Italy.

Raha S K 2009 Status of Dairy Production and Marketing in Bangladesh – Milk marketing system. Handbook of Dairy Nutrition-Bangladesh. Edited by Peter H. Robinson and U. Krishnamoorthy. Published by American Soybean Association (ASA), International Marketing, New Delhi, India.

Saadullah M 2001 Smallholder Dairy Production and Marketing in Bangladesh. Paper presented at South-South Workshop on Smallholder Dairy Production and Marketing. NDDB-ILBS. 13-16. March. 2001, Ahmedabad, India.

Sarker N R, Huque K S and Khaleduzzaman A B M 2012 Feeds, Fodder and Feeding Challenges for Bangladesh. Paper presented in the Seminar and Reception: Animal Husbandry Education and Profession in Bangladesh- A journey of 50 years organized by Bangladesh Animal Husbandry Association, Dhaka, Bangladesh. pp 51-61.

Received 12 May 2014; Accepted 9 September 2014; Published 3 October 2014